Understanding US Inflation Trends: A Comprehensive Guide to Inflation Rates from 2000 to 2025

Table of Contents

- Cali. residents to receive up to ,050 in 'inflation relief'

- Southern California inflation heats up in early 2024 – Orange County ...

- California Economy & Taxes on Twitter: "Inflation has decreased from ...

- Final California inflation relief payments coming: Heres' when | FOX 11 ...

- Cali. residents to receive up to ,050 in 'inflation relief'

- California faces a record BILLION budget deficit thanks to soaring ...

- Can California’s next governor fix the state’s problems? It depends on ...

- Current Inflation Rate California 2024 - Gerrie Sharline

- Current Inflation Rate California 2024 - Ali Dorothy

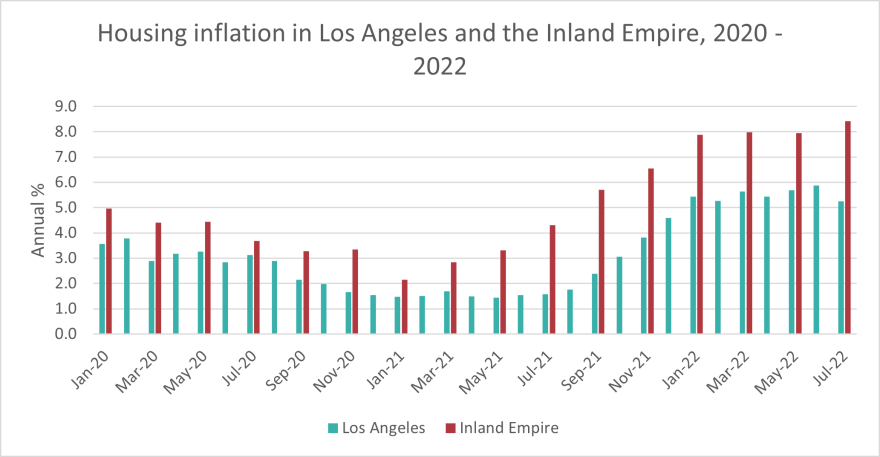

- Inland Empire experiencing higher inflation rate than Los Angeles and ...

Historical Inflation Rates: 2000-2020

The following table highlights the annual inflation rates in the US from 2000 to 2020:

| Year | Inflation Rate |

|---|---|

| 2000 | 3.4% |

| 2001 | 2.8% |

| 2002 | 1.6% |

| 2003 | 2.3% |

| 2004 | 3.3% |

| 2005 | 3.4% |

| 2006 | 3.2% |

| 2007 | 2.9% |

| 2008 | 3.8% |

| 2009 | -0.4% |

| 2010 | 1.6% |

| 2011 | 3.0% |

| 2012 | 2.1% |

| 2013 | 1.5% |

| 2014 | 0.8% |

| 2015 | 0.1% |

| 2016 | 2.1% |

| 2017 | 2.1% |

| 2018 | 2.4% |

| 2019 | 2.3% |

| 2020 | 1.2% |

Projected Inflation Rates: 2021-2025

Using a US inflation calculator can help individuals and businesses make informed decisions about investments, savings, and pricing. By understanding the current and projected inflation rates, you can better navigate the economy and make smart financial choices.

In conclusion, understanding the current US inflation rates from 2000 to 2025 is crucial for making informed financial decisions. By analyzing historical data and projected trends, individuals and businesses can better navigate the economy and make smart choices about investments, savings, and pricing. Whether you're a consumer, investor, or business owner, using a US inflation calculator can help you stay ahead of the curve and achieve your financial goals.Stay up-to-date with the latest inflation trends and forecasts, and use the valuable insights and tools provided in this article to make informed decisions about your financial future.